Insurance firms have up to mid-January to pay claims from injured police officers

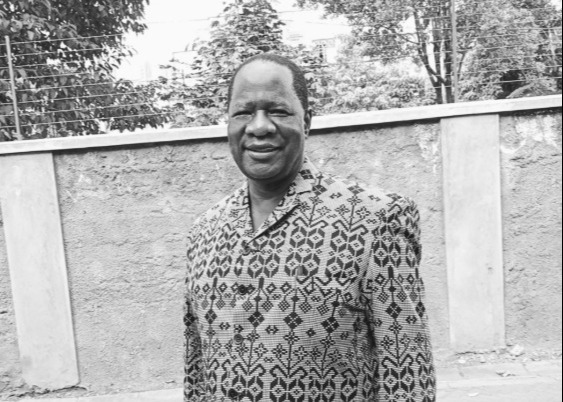

Senator Seki Lenku criticised the delays as intentional barriers to denying officers compensation.

Insurance companies handling a Sh5.1 billion compensation cover for injured police and prison officers have until mid-January 2025 to settle all outstanding claims.

The directive, issued by the Senate Committee on National Security, follows a contentious session in which lawmakers criticised delays and irregularities in processing claims for officers injured in the line of duty.

More To Read

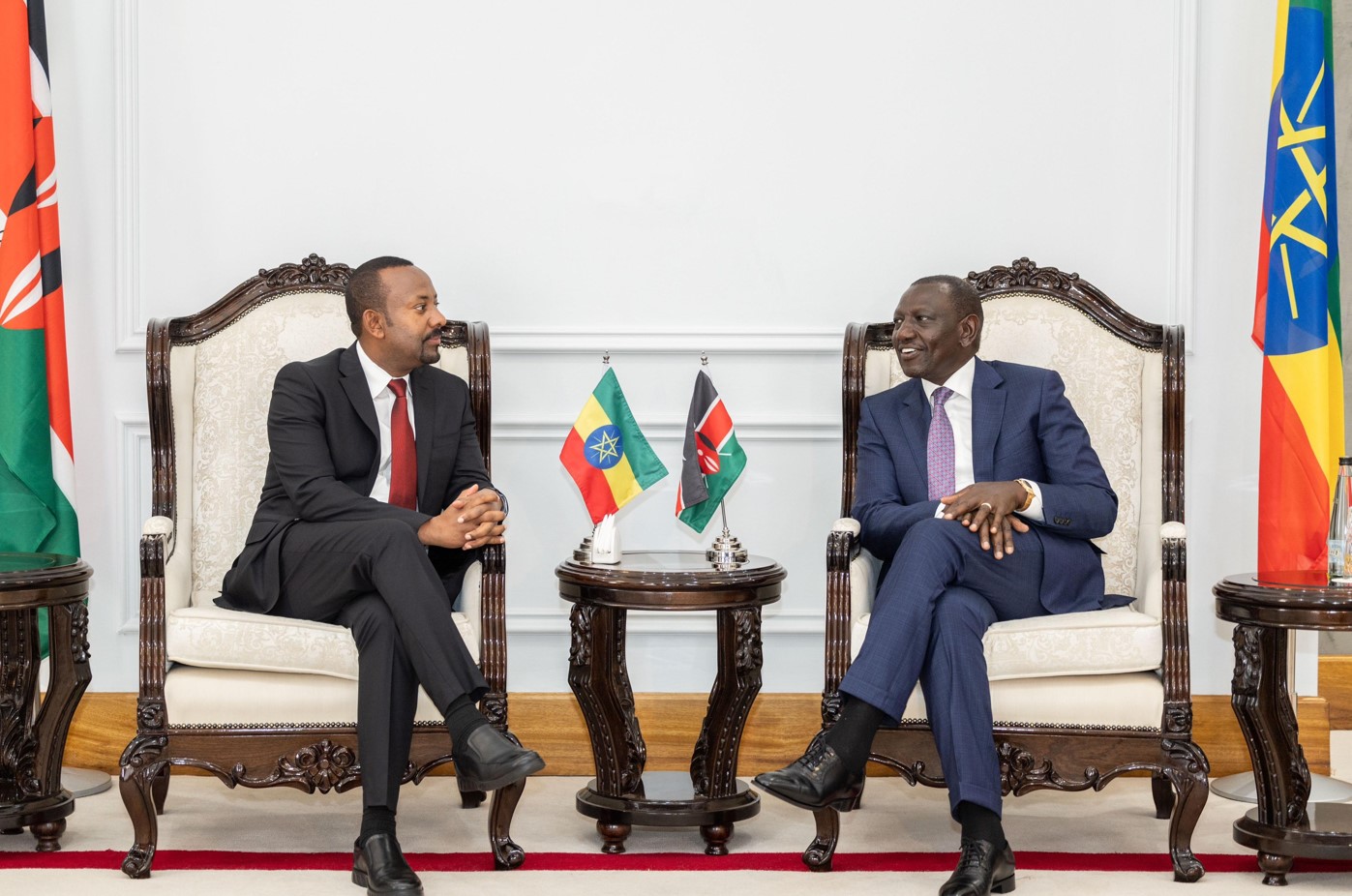

- Governors reject President Ruto’s order to absorb 7,400 UHC workers

- House committee grills TSC over gaps in teacher welfare, policy

- MPs slam Ministry of Health over SHA failures, demand urgent reforms

- Section of MPs warn e-procurement rollout may deepen corruption instead of curbing it

- Ruto announces government to pay SHA contributions for 1.5 million Kenyans from next week

- National Assembly summons Police IG Douglas Kanja over delayed reforms, payroll issues

The affected officers, covered under Group Life, Last Expense, Work Injury Benefits Act (WIBA), and Group Personal Accident (GPA) schemes, have faced years of frustration, with claims dating back to 2021 and 2022 remaining unresolved.

A document presented to the committee on Thursday revealed that out of 2,162 claims, only 937 have been paid, while hundreds remain rejected or under review due to disputes over documentation, delayed premiums, and requests for second medical assessments deemed illegal by law.

A key hurdle, it emerged, is the government's failure to remit Sh4.1 billion in premiums for the current coverage period, leaving the insurance firms unable to honour claims promptly.

This shortfall affects police officers deployed in high-risk areas, both locally and abroad, including Haiti.

During the meeting, committee members, led by Nominated Senator Karen Nyamu, the vice chairperson, grilled representatives from the Social Health Authority (SHA), National Police Service Commission (NPSC), and insurance firms, including Jubilee Allianz, Britam General, and UAP Insurance.

The discussions centred on allegations that insurers demanded second medical evaluations from injured officers, contravening provisions of the WIBA Act.

"The law does not provide for second assessments. This is a clear injustice to officers who risk their lives daily," said Augustine Wafula from SHA, denouncing the insurers' practices.

On duty at all times

NPSC Chairperson Eliud Kinuthia said that police officers are considered on duty at all times, including during leave, debunking insurers' claims that some injuries occurred outside official duty.

"This cover recognises the vulnerability of officers due to the nature of their work. It is not conditional," he stated.

Senator Seki Lenku criticised the delays as intentional barriers to denying officers compensation.

"Why are officers subjected to unnecessary assessments? These practices only serve to frustrate them further," he argued.

The committee has mandated all stakeholders, including the NPSC, SHA, and insurers, to collaborate with the Directorate of Occupational Safety and Health Services (DOSHS) to resolve the backlog of claims by the third week of January 2025.

Other Topics To Read

"We expect a full report on resolved claims by January. There is no room for further excuses," warned Senator Nyamu.

Claims breakdown

The Kenya Police Service accounted for most of the claims, with 998 cases filed. The Administration Police followed with 686 claims, while the Directorate of Criminal Investigations (DCI) had 72 claims during the same period of FY 2021-2022

The process for making a claim begins when an officer reports the injury to their immediate commander, who submits a formal notification to police headquarters.

A claims officer then fills out Form 1 at DOSHS.

Once the officer has recovered, or during recovery, they must submit medical reports, identification documents, bank details, and a police abstract.

In the event of death, additional documents like a death certificate, burial permit, and post-mortem report are required.

After compiling all the necessary documents, the claim is sent to the insurance service provider with a forwarding letter.

The insurer then forwards the claim to DOSHS, which arranges a medical assessment to determine the degree of disability.

Finally, DOSHS prepares an agreement form outlining the computed compensation amount.

Top Stories Today